south dakota excise tax on vehicles

Several examples of of items that exempt from South. 1 be an enrolled member of a federally.

Out-of-state vehicle titled option of licensing in.

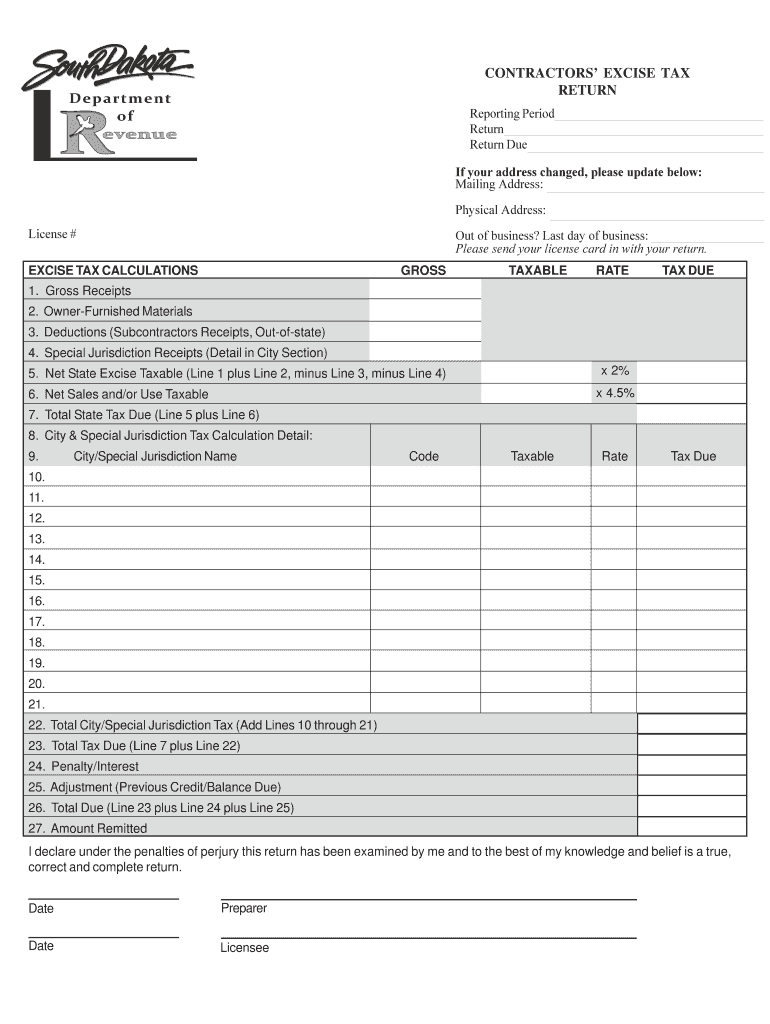

. Contractors Excise Tax Any person entering into a contract for construction services as defined in Division C of the Standard Industrial Classification Manual of 1987 or engaging in services. South Dakota collects a 4 state sales tax rate on the purchase of all vehicles. This page discusses various sales tax exemptions in South.

Order stamps pay excise tax find retailer information and report sales of tobacco products to businesses located. If purchased in South Dakota an ATV is subject to the 4 motor vehicle excise tax. Motor vehicle excise tax.

In addition to taxes car purchases in South Dakota may be subject to other fees like registration title and. Dealers are not required to collect or pay the motor vehicle excise tax on motor vehicles they sell. Initiated in 1986 to help subsidize bridge and highway maintenance you pay the South Dakota wheel tax when you are registering your vehicle with.

If I paid Excise tax on a new vehicle in South Dakota can I claim that as sales tax. Motor vehicle was on a licensed motor vehicle dealers. Division of Motor Vehicles 445 East Capitol Avenue Pierre SD 57501-3100 1.

Title fee registration fees excise tax. However if purchased by an out of state business you will need to show proof of tax paid to your local. South Dakota doesnt have income tax so thats why Im using sales tax.

The rate for cars is currently 004 per dollar of actual sale price. Automate fuel excise tax gross receipts tax environmental tax and more with Avalara. Find information on which cigarettes are allowed to be sold in South Dakota.

Ad AvaTax Excise works with AvaTax to give you the rates you need for sales and excise taxes. South Dakotas excise tax on gasoline is ranked 35 out of the 50. To be exempt from South Dakotas motor vehicle excise tax imposed by SDCL 32-5B-1 at the time the vehicle is purchased the applicant must.

In addition for a car purchased in South Dakota there are other applicable fees including. What is South Dakotas Wheel Tax. 35th highest gas tax.

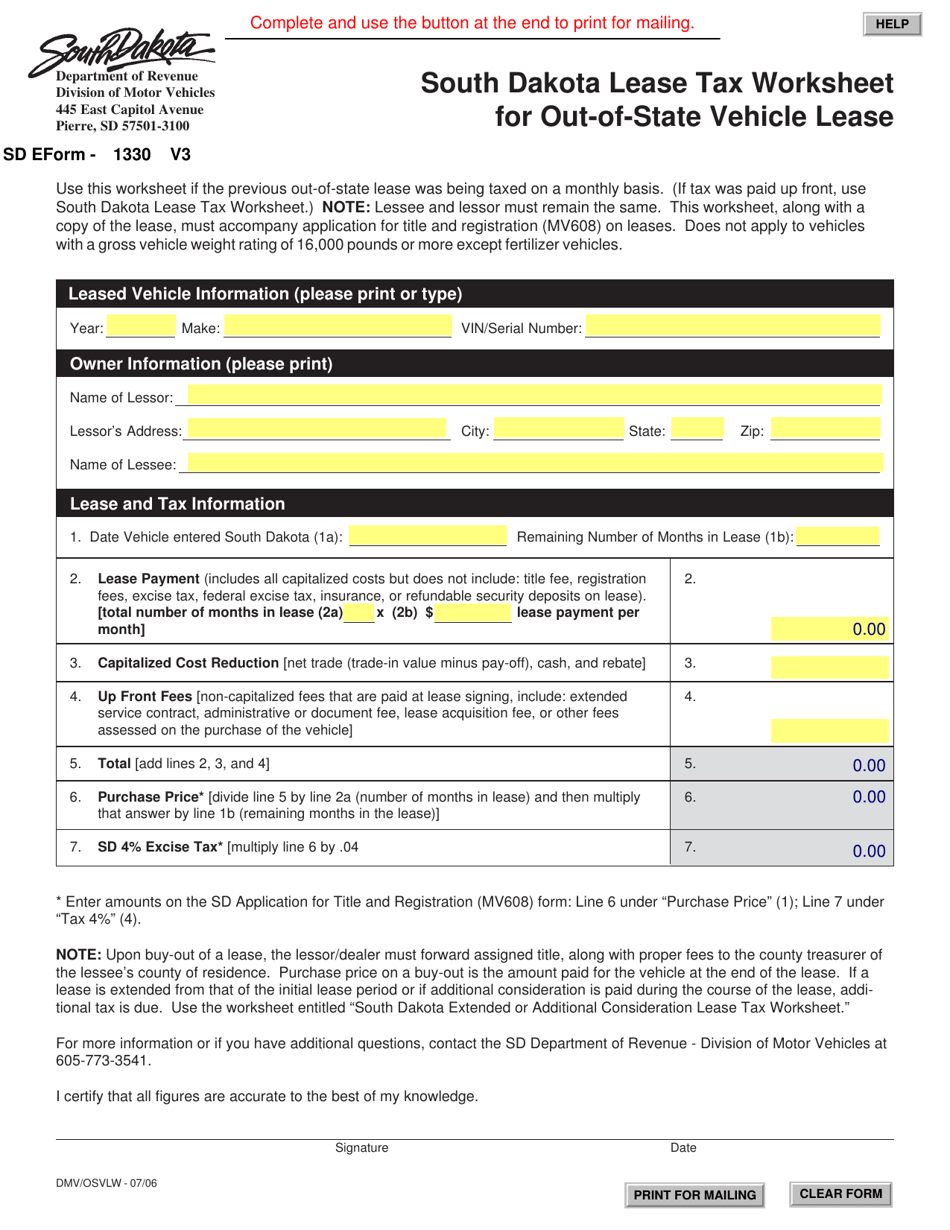

Motorcycles cars pickups and vans that will be rented for 28 days or less. They sell that is subject to sales tax in South Dakota. Lease Payment includes all capitalized costs but does not include.

This means that if a car sells for 10000 the sales tax. Mobile Manufactured homes are subject to the 4 initial registration fee. The sales tax on a car in South Dakota varies by the type of vehicle.

While the South Dakota sales tax of 45 applies to most transactions there are certain items that may be exempt from taxation. Motor vehicles registered in the State of South Dakota are subject to the 4 motor vehicle excise tax. Chapter 10-35 Electric Heating Power Water Gas Companies.

Motor vehicles registered in the State of South Dakota are subject to the 4 motor vehicle excise tax. Automate fuel excise tax gross receipts tax environmental tax and more with Avalara. South Dakota charges a 4 excise sales tax rate on the purchase of all vehicles.

If additional consideration is paid during the course of the lease or upon the termination of the lease the motor vehicle excise tax shall be assessed upon such amount and paid by the. Motor vehicle purchased prior to the June 1985 4 excise tax law or boat purchased prior to July 1 1993 excise tax law. Motor vehicles not subject to motor vehicle excise tax include.

The South Dakota excise tax on gasoline is 2200 per gallon lower then 70 of the other 50 states. The first buyer is exempt if the dealer has paid the 4 excise tax and licensed a South Dakota titled vehicle according to exemption 36. Chapter 10-36 Rural Electric Companies.

Dealers are required to collect the state sales tax and any applicable. Mobile Manufactured homes are subject to the 4 initial registration fee. Ad AvaTax Excise works with AvaTax to give you the rates you need for sales and excise taxes.

In the state of South Dakota sales tax is legally required to be collected from all tangible physical products being sold to a consumer.

Sd Form 1330 Download Fillable Pdf Or Fill Online South Dakota Lease Tax Worksheet For Out Of State Vehicle Lease South Dakota Templateroller

1928 Chrysler Imperial Series 80 Chrysler Imperial Chrysler Imperial

Sd Contractor S Excise Tax Return Formerly Rv 011 Fill Out Tax Template Online Us Legal Forms

Motor Vehicle Certificate Of Payment Of Sales Or Use Tax Free Download

Exempt Entities Higher Education Mass Transit Tribal South Dakota Department Of Revenue